By Conrad Zurini | Broker of Record/Owner

What you are about to read is far from medical advice. It is more of a metaphor on how the human mind works with too much information at its finger tips. A few weeks ago my body put me on a wild goose chase to figure out what ailment I was experiencing.

It all started early one morning at 3:00 am when I woke up with a burning pain in my arm. It was my left arm, (you know what that means), so I went to Dr. Google and you know what they said. Then the pain went to my back, and you know what I thought. This weird left arm pain continued and I had a feeling of being generally unwell. Later that day I phoned someone I knew who just had a major heart attack, and he generously went through his journey from symptoms to the actual heart attack itself. My mind began to take over, and his advice to me was stellar. But being a typical man, I took an Advil and my classic symptoms of a heart attack ended up going away.

I then proceeded with my day and did an upper body workout. One day later I felt an ache in my left shoulder and my shoulder blade. I chalked it up to some muscle strain from my workout. The next day, no matter what I consumed, I felt nauseous, I told my mom that the smell of coffee made me nauseous, and she told me that happened to her when she was pregnant. Could I be pregnant and my body was sending me all these messages? Just kidding! I started feeling fatigued and had occasional headaches, coupled with every other symptom. Dr. Google asked if I had a life insurance policy.

The funny thing is, as the symptoms came and went, one always persisted - itching on my back on my left side. Nothing appeared to be there for 1 week, but all of a sudden a small rash appeared at the site of the itch. However, now when I scratched it, it felt like my back was on fire. So of course, I went back to Dr. Google and did a long tail search. That’s when you make a long list in the search bar. Google gave me a list of 10 things it could be, each one worse than the other. The third on the list, (and you may have guessed it already), was dreaded SHINGLES!!!! I took a very unglamorous selfie of my back and sent it to my doctor, to which he responded “it’s definitely shingles, where do I send the prescription?”

I’m happy to say I am on the mend, however it made me think of all the searches that occur on Google everyday, and all the health advice we get from our friends and family. And I thought how frustrating it must be for the medical profession when people treat themselves with Dr. Google. So I decided to do searches about our industry…real estate. I searched ‘when is the best time to buy a house’, or, ‘should I sell my house now’. The answers were not really scary and lacked any quantitative analysis. But what got my attention was what ‘People also searched for’. These included: ’Should I sell my house before the market crashes’, ‘should I sell and rent instead’, ‘Is it smart to buy a house right now’ and ‘will house prices drop in 2023’.

If you have read any of my previous blogs, I try to give advice with a heavy dose of quantitative analysis. This article is no different, so lets take a deep dive into the collective health of the Canadian real estate market.

Buyer Remorse?

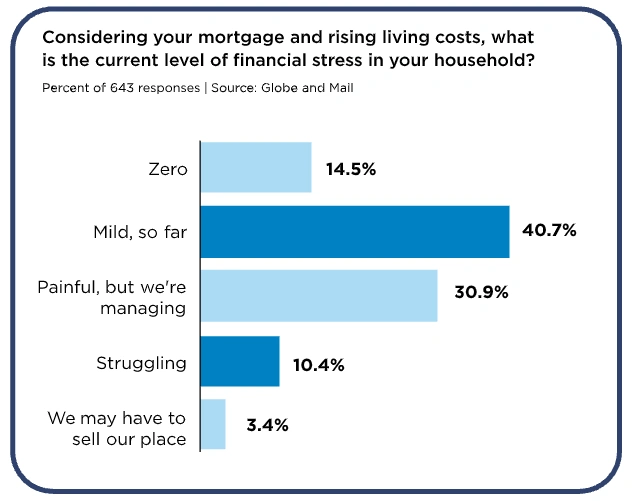

Recently the Globe and Mail did an informal study and published some of the results on November 10th 2022. While recent home Buyers may feel the pressure of the market, inflation and rising interest rates, few show regret or feel they have to unload their burden. When home Buyers were asked about their current level of financial stress, only 3.4% said “we may have to sell our place”. And as far as I’m concerned the most important question in the survey that truly measures home Buyers sentiment, is the one which asks about their attitude toward home ownership. Only 7.7% of respondents regret buying; nearly 25% are loving it; 36.4% said owning a home is stressful but worth it; and the rest were indifferent.

See Graph Below

To Variable or Not to Variable

A 2001 study by professor Moshe Milevsky from York University, proved that for 50 years (1950 - 2000) variable rate mortgages saved borrowers money 88% of the time over fixed rate mortgages. Milevsky, in a recent interview explained, how currently in mortgage history we are in the 12% zone. What is unexpected about conventional mortgage knowledge is the fact that variable mortgages reign king in the Canadian market. As of August 2022, variable rate mortgage originations outstrip fixed mortgages compared to pre-Covid levels. Is it that today’s Buyers are confident in the market, and see these high interest rates as temporary? Many mortgage specialists and Realtors, are advising their Clients to take either a short term fixed, or a variable rate mortgage, and ride the temporary storm before rates drop and home prices in turn increase.

Private Lenders Are Swamped

As the overnight rate rises in Canada, and the stress test rises along with it, Canadian home Buyers are seeking out alternatives to traditional lenders. As a result of this voracious appetite, private lenders are increasing their equity requirements to stave off demand. It was recently reported, (Globe and Mail November 12, 2022), that private lender MCF Mortgage Investment Corp., had to suspend new applications because it was “inundated with new borrower applicants”.

Rents…They Are A Rising

According to Rentals.ca, year over year rental rates have risen 11.8% over all property types, and 13.97% for one bedrooms in Canada. A one bedroom (October 2022) in Vancouver is up 17.2% ($2,576), up 23.7% in Toronto ($2,478), up 15.1% in Burlington, up just 5.6% in Oakville, up 13.3% in Hamilton, and 17.3% in St. Catharines. Since interest rates began to rise on that fateful day in March 2022, rents in Canada have increased by 9.2% while the benchmark resale price has fallen nearly 10%.

The Final Word on the Health of The Canadian Housing Market

What does billionaire Steven Smith know that every financial reporter, bank economist, and CMHC analyst doesn’t know? He just put a bid in for $1.7 billion dollars to buy Home Capital, a leading alternative lender in Canada. A far cry from the days back in 2017, when Home Capital was saved from the brinks of financial ruin, and the infamous Warren Buffett bought a 19.9 stake in the ‘B’ lender. Buffett’s Berkshire Hathaway Inc. recently sold their position, and earned them a 70% return, allowing Steven Smith an opportunity to launch a takeover bid. Smith’s favourite saying is “Be greedy when others are fearful”. It sounds like he is making a solid bet on the Canadian Housing market, and has no fear of any collapse. You see, of all the links in the chain of the Canadian Housing market, ‘B’ lenders are one of the weakest. The only weakness Smith sees is in the way the health of the housing market is portrayed day after day in Canada. We are in the age of the self educated consumer, and I applaud Canadian home Buyers and Sellers for researching the market, but eventually we have to treat our condition and/or our circumstances with professional advice.