By Conrad Zurini | Owner and Broker of Record

I’m going to take you back to your high school English class when you studied Shakespeare’s Julius Caesar. In it, the soothsayer, Plutarch, warned Caesar to "Beware the Ides of March’’. Before we go on, what does ‘ides’ mean? I remember daydreaming in my grade 10 English class, my homework was not complete, and my teacher asked me to explain what the ‘ides of March' were. I heard ‘eyes of March’, and began to explain that back in Roman times (44 BC) they believed that the middle of March had eyes (figuratively of course) and, in conjunction with the appearance of the full moon, you could predict the future. My english teacher wasn’t sure if he should reprimand me or compliment my creativity. But if you must know, the Latin root of ‘ides’, which means ‘to divide’, literally means the middle of the month. In Roman times the ides of March were known as the date to pay off debts, and of course March 15th, 44 BC, was when Julius Caesar met his demise.

Fast forward to March 15, 2020 when our lives all underwent a seismic shift. That night there were many reports and opinions on Covid-19, and how the world was going to shut down to combat its spread. On March 2nd, 2022 the Bank of Canada announced the first of many rate increases, and by mid-March (the ‘ides’) the market had begun to furiously react to the .25% increase in rates. March 8th, 2023 the Bank of Canada held its target for the overnight rate at 4.5%, and by March 15th, 2023 we had the beginnings of a brisk real estate market. The ides of March were good this time!!!!!

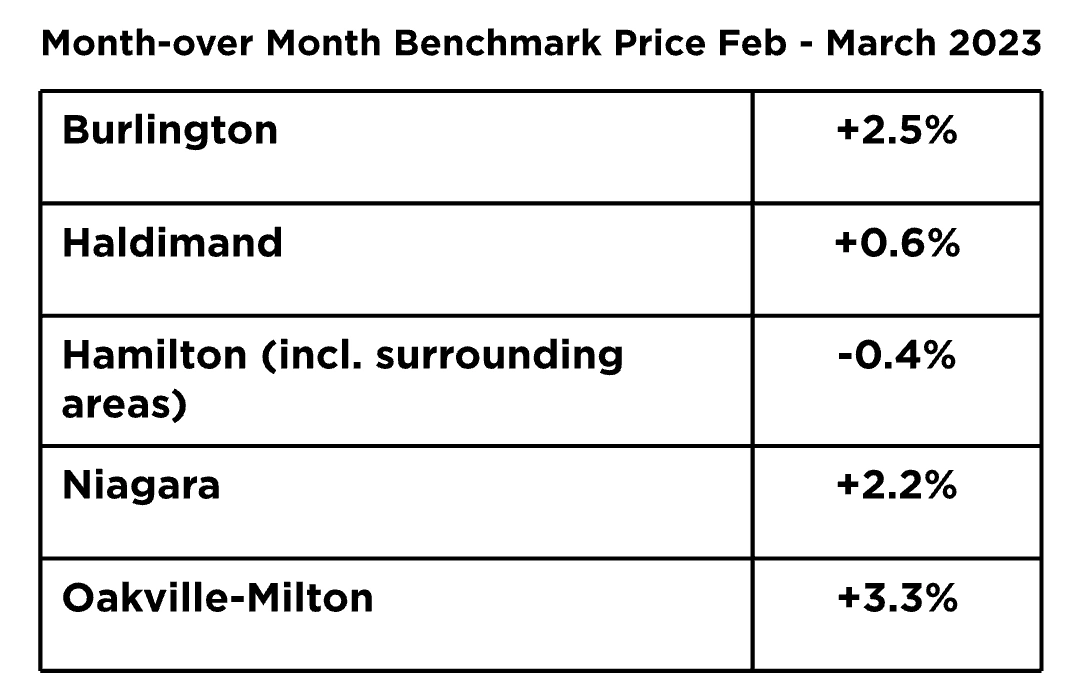

Benchmark Price Positive In Most of Our Surrounding Markets

The bottom of the market has finally come and gone. The following chart shows the Benchmark composite price in all of our trading areas. Aside from Hamilton and surrounding areas, which are difficult to separate out (Ancaster, Waterdown, Binbrook, Stoney Creek, etc.), many of the markets we serve are up from the month of February.

Blackstone Doubles Down on Real Estate

When it comes to real estate, I always look at what the best real estate minds are doing, so I ask what would Blackstone do? Recently, Blackstone announced the close of its latest $30.4 billion global real estate fund (BREP X - Blackstone Real Estate Partners X), the largest real estate fund ever raised. This fund will be focused on logistics facilities, hospitality, data centres and, of course rental housing. Blackstone has $326 Billion of investor capital under management, and by their own admission they own 0.02% of all the single family stock in the United States. You do the math. Their funds have delivered a net 16% internal rate of return for over 30 years. A large chunk of this money flowed into the BREP X fund, just as there were rumours of more bank failures in the United States, proving once again that money flows rapidly to bricks and mortar during times of uncertainty.

Buying A Home Is Still The Best Way To Save

Mortgage payments are no fun, but with rents up over 19% year over year in our area, renting can’t be that much fun either. There was a recent H&R Block Canada Inc. study (April 3rd, 2023), where 52% of Canadians don’t feel they have enough money left at the end of the month to save for their retirement.

If you were to buy a home for $750,000.00 with 5% down at an interest rate of 4.5%, your principal payment would be $1300.00 a month. That’s over 17% of the average household income, and that’s way more than an average renter is saving.

We have data that has been collected for over the last 40 years on home appreciation, which pegs the Canadian national average home appreciation at 5.87%. If you take off nearly 1% of that appreciation for municipal taxes, home maintenance and Insurance, and round it down to 5%, your net appreciation after 30 years would be $2,491,456.78. That’s 71 times your original 5% down - not too shabby!!!!

TD published a report back in October of 2022 which showed that if you were born between 1955 and 1964, the average net worth of a homeowner was around $1.4 million by 2019, compared to $200,000 for the average non-home owner. TD went on to say that back in 2005, the gap was $500,000. Wait until this is calculated for post pandemic real estate values!

The Bank of Mom and Dad is Thriving

Recently, Rob Carrick, friend to the real estate industry (NOT!!!!!), and business columnist for the Globe and Mail, did a survey with over 3000 respondents, about how parents are helping their adult children. The results were no surprise, but what got my attention was the fact that many parents are doing their part to help their kids buy a home. They were either lending the money outright, or providing free room and board so that their children could save for a down payment.

More good news for parents helping their children purchase their first home is the First Home Savings Account that was just launched on April 1st, 2023. It allows first-time buyers to put $8,000 per year in a tax free savings account, up to $40,000. If you start this when your child or grandchild is 19 years old, by the time they are 24 they would have $40,000 to put towards a down payment. Also, the program allows the tax deduction to be carried over until your teenage dependent starts making money, well after they graduate.

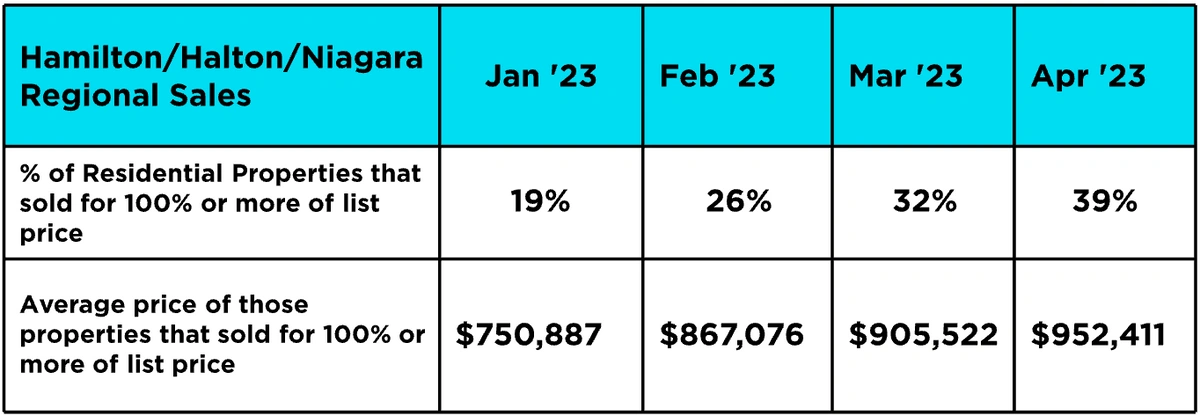

March Consumer Confidence Leads to the Start of a Robust Spring/Summer Market

The March and April pause in interest rate hikes by the Bank of Canada has added a much-needed boost to the real estate market. Consumer confidence in housing is coming back, as we have seen in our recent weekly appointment numbers, which have finally surpassed April ‘22 appointments by over 10%. Also there has been a trend in properties selling over asking price. When you take into consideration properties which sold for 100% or better in the month of March in Hamilton, Halton and Niagara, it accounted for 32% of the properties sold, with an average price of $905,522. When you run the same query for April of 2023, 39% of the residential properties sold met the criteria of 100% of the asking price or better. The average price of these sold properties was $952,411, an increase of 5.2% over the month of March. Fasten your seat belts, and don’t plan a long summer vacation. The ‘ides of March’ have predicted a spring market, which depending on inventory ebbs and flows, will blend into the proverbial fall market.