An Ode to A Canadian/American Home Buyer/Seller

I recently had the pleasure of being in San Diego to attend a real estate conference. I have experienced the joy of visiting San Diego a total of 5 times in my life, I have told the story several times where, during each trip to SD, I make a pilgrimage to the Hotel Del Coronado (Del for short), which is an all-wood Victorian-style building built in 1888. My ritual visit consists of me sitting at the bar at the Serea, and taking in the sights and sounds of this incredible beach property. The first time I did it, I had a tear in my eye thinking of the fact that my parents chose the City of Hamilton to raise their family instead of this beautiful place.

I’m not sure why I am attracted to this landmark, it could be that it was the first commercial building lit by electricity, where Thomas Edison himself supervised the installation. Or perhaps the fact that Elisha Babcock and Hampton Story, two men without any hotel experience built the hotel on 4,000 oceanfront acres they bought for $100,000, which works out to $25 an acre. I couldn’t even guess what the land would be worth today, who says real estate is a bad investment. Or it could be that nearly a dozen presidents stayed there, along with a whole list of actors and foreign dignitaries; that it is rumoured to be haunted; or that Liberace was discovered there. It just seems to me like a piece of a bygone era is captured within its walls and on its most beautiful grounds.

I had this elaborate plan to fly in early on Sunday morning so that I could get a head start on my Hotel Del Coronado day. I was to leave my home around 3:30 am to be at the airport comfortably before I took off at 6:30. Well, Mother Nature had a different plan; hers was to bring a fury in the form of lightning in and around Pearson Airport. So, as I was about to get up in darkness, I was annoyed by a pinging, which was a series of texts. The pinging went on and on, and I wondered who on earth would be texting me at that ungodly hour. It was the airline telling me that my flight was delayed. This delay was caused by a series of cancellations, which made my trip like a scene from planes, airports, more planes, more airports, and automobiles.

My plan to visit my so-called North American Mecca was ruined and made me think of the expression “The best laid plans of mice and men often go awry” a well-known saying from a Robert Burns poem from 1786. As the poem goes, a mouse painstakingly builds a nest for the winter in a farmer’s field. The mouse saw this vast fertile uninterrupted sundrenched area and felt it was a great spot to build a home. But a farmer inadvertently ends up destroying the nest whilst ploughing his field. The poem “To a Mouse” opens with an apology to the mouse and goes on to describe the fact that no matter how much you plan and prepare, you cannot control your own fate.

It made me think of the real estate market like Burn’s farmer’s field. The real estate market has been fertile for the past dozen years at least, with uninterrupted average home price increases, not to mention well over a decade of inventory shortages. So many consumers, myself included, decided to put some or all of their money to work in hard assets... physical real estate. Then along came the Bank of Canada (US Federal Reserve) with the plough in March of 2022 and partially destroyed what we all had worked for, with their 10 successive rate increases.

I am not holding my breath to read an apology poem by either Tiff Macklem or Jerome Powell entitled ‘To a Home Buyer,’ but I do feel that their death by a thousand small rate increases, and now by a thousand small rate decreases, is fundamentally flawed and sets a false consumer expectation, but I digress.

Let's Set the Record Straight

The peak of the market was probably March 2022 where the Canadian Benchmark price was $852,000, which coincided with the March 2nd 2022, when the BoC doubled the overnight lending rate to 0.5% after 2 years of holding the rate at 0.25%. The Benchmark Composite Price (BCP) reacted almost immediately. Two months later, in May of 2022, the BCP dropped 3.6%, and by July ‘22 it dropped a whopping 10% in only 4 months.

So why didn’t anything happen when the rates dropped in June of 2024? Conditions were very different in 2022. We had just come off a very robust market, and in the second quarter of 2022, endof-month inventories grew by 80% in some markets in Ontario. It became clear that those who had planned to sell their homes to take advantage of a rising market had missed the top of the market, and furthermore, the train had already left the station, but they still proceeded to sell without looking at the current inventory levels. Those sellers were hit with head winds beyond their control. They probably decided to sell their home early in late 2021 or early 2022, and put a plan together in January. By the time everything was ready to go, the market had taken a turn… the best laid plans of mice and men.

Why Are We Whining So Much?

CREA reported nationally, “Home sales activity was up by 4.8% from year-ago levels in July 2024,” and in Ontario, sales increased by 2.9% from July 2023. As far as the CREA home price index, it was up 0.1% month-overmonth, with Calgary’s annual median price is up 14%, the strongest market in Canada. The Canadian Real Estate Association further stated that “Residential sales activity reported through the MLS® Systems of real estate boards in Ontario numbered 14,858 units in July 2024. This increased by 2.9% from July 2023. While home sales were 19.9% below the five-year average and 23.4% below the 10-year average for the month of July.”

The Dhulaigh Curve Gives Hope to the Fall Real Estate Market

The slight increase in unit sales in the economic engine of the country, Ontario, illustrates how the market has turned the corner and is showing some signs of momentum. So why is everybody whining so much about real estate? Historically 40% of housing inventory was placed on the market during the spring, which led to corresponding sales activity. The summer months were when 20% of the annual inventory would come on the market, leading to lower sales activity, with the fall wrapping up the year with the remaining 25%.

This is known as the Dhulaigh Curve, but for 2024, it has been reversed, with 40% of the listings coming in the fall. What is remarkable is that the dozen or more years prior to Q1 of 2022, we in the real estate industry complained about the shortage of inventory, be careful what you wish for!!!

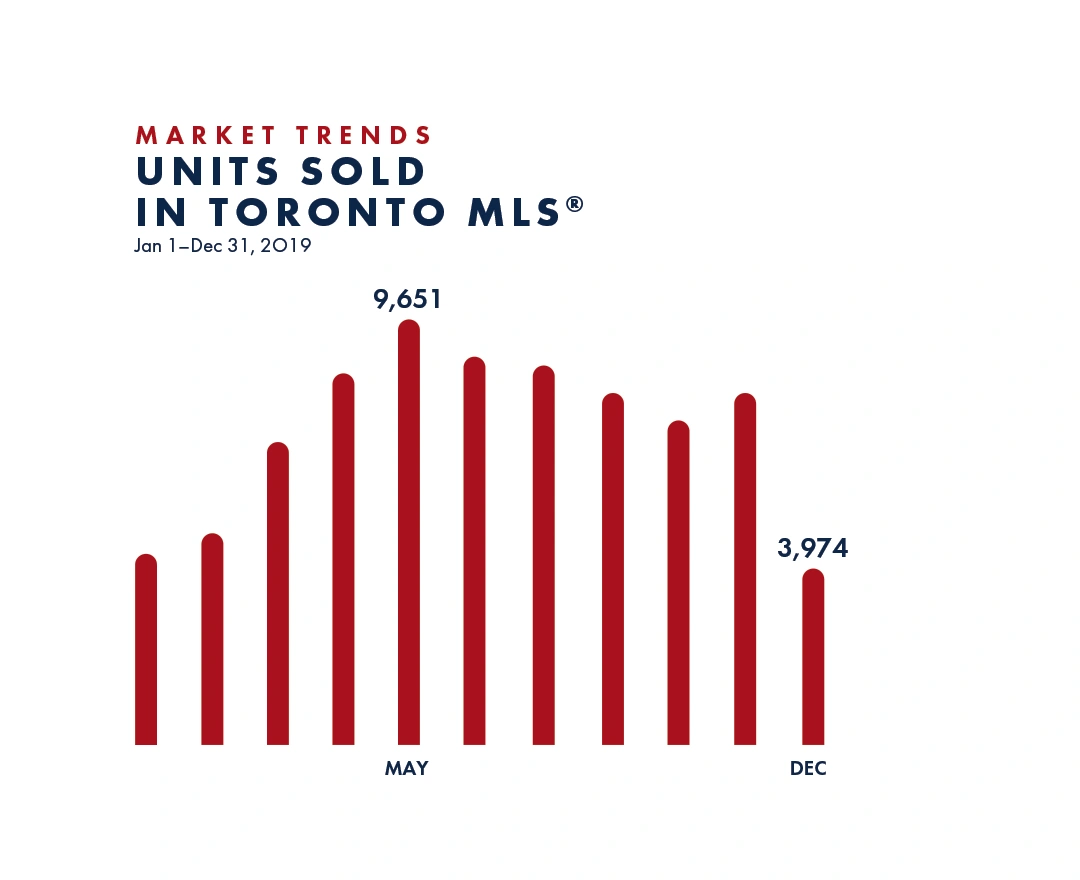

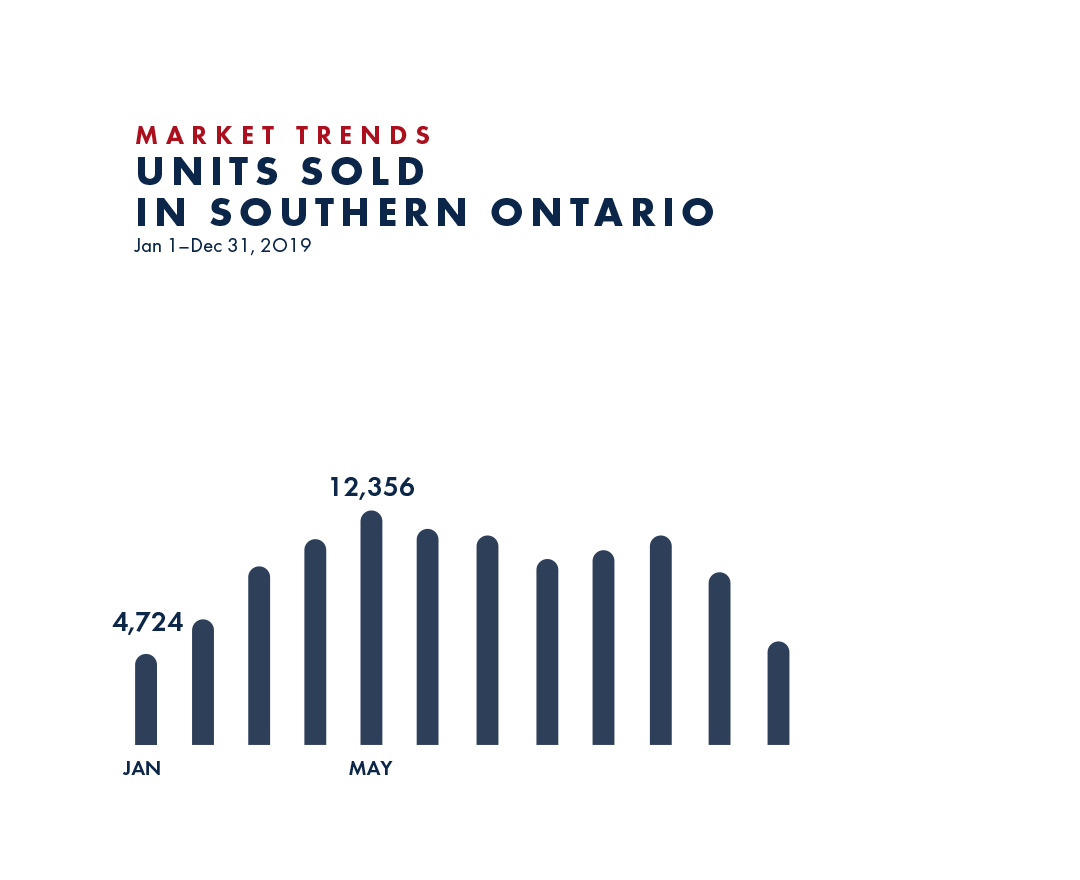

The last time in real estate history where we saw this reversal of sales fortune was back in 2019. If anyone remembers, the Canadian government became concerned that if mortgage rates ever took off like a rocket, they needed to know that the Canadian mortgage holder could weather the storm. So came the stress test. It really put a psychological and practical damper on the market because borrowers had to qualify for higher rates. It took more than a year for the market to adjust to this new obstacle, but we weathered the storm. As a result, when you look back at the sales activity of 2019, we can see how an earth-shattering event like the stress test lead to a reverse Dhulaigh Curve, similar to how an historically substantial rise in mortgage rates took well over a year to adjust to the new normal.

Did Robert Burns Get It Wrong?

Let’s face it: Robert Burns was not correct in his statement about the best laid plans when it comes to real estate. People change jobs, families grow, seniors downsize, couples divorce, and heirs receive an inheritance. The milestones of life keep happening. Just because a plough comes along doesn’t mean it destroys the plan forever, all it means is that it is postponed. It may look on the surface a little different, but what remains is our desire for a place to call home and for our investment in it to grow. Last time I checked, real estate unequivocally checks those two very important boxes.