Article written by Conrad Zurini | Broker of Record | Manager

I know that all you dog lovers out there may be offended by this analogy, but the real estate market in Canada is not about the unconditional love and devotion that a dog gives you. Unlike your golden retriever named Biscuit, its not always happy when you come home, it does have a sense of time, its unforgiving, its aloof, its strategic, and it doesn’t like when things are untidy.

I have a cat named Emily who is typically a real cuddler, but when I come home after a trip or am late during the week, there is hell to pay. Her meow is curdling and illustrates her displeasure of abandonment. Many a time I have left my packed bags at the front of my home before a trip along with my passport so I wouldn’t forget it. Emily figured out that when these boxes with handles come out, I would be gone the next day. She couldn’t show noticeable displeasure toward my luggage but one time she chewed through my passport, making it invalid (I was thinking inhumane thoughts when my trip had to be postponed). A dog has no concept of your time away. You could leave for 10 minutes, and your canine will greet you like you just climbed Mount Kilimanjaro.

If I fail to keep Emily’s litter box in pristine condition, I am left with a small present (a piece of poop) in an area where she

knows I will travel. The fact that a cat relieves themselves in a dedicated area makes them miles above in IQ of their four-legged counterparts, dogs. For dogs, the entire world is their toilet, and they are unnervingly attracted to the scent of another dog’s discharge, not to mention their own.

You see the Canadian real estate market has an air of sophistication like a cat, and requires strategy, cunning and an appreciation for time. First, let’s not waste time on what we cannot control, like interest rates, recession, inflation etc. You see, my cat Emily cannot control when I come and go, how tidy I keep her litter box, but she can give me subtle signs of her displeasure. Are you watching for those subtle signs from your database, your friends, your past clients, and your social network?

Why People Move...Nothing to do With Mortgage Rates

I have assembled a list of why people decide to move/sell/buy, it by no means is exhaustive, but it does highlight that everything does not evolve around mortgage rates. Every time you get a listing, you should run it against this list, see if it fits with 2 or more scenarios, and create ads which speak to the profiles below.

1. Family ties: People want to live closer to loved ones. The sandwich generation would like to live closer to their elderly parents who might be moving to a long-term care or retirement home. Showcase the fact that a property is within a radius of a number of these types of facilities, or alternatively, highlight suburban condos where elderly down-sizers can move and be close to their suburban grandchildren.

2. Needing a bigger space: Life goes on and a person’s household needs change. It’s time we focus on price per square foot, which is a fantastic way to show value and enable a growing family to stretch out. Not to mention 4 and 5 bedroom homes are on buyers’ radar screens.

3. Love their existing rate but hate their house: Get familiar with blend and extend mortgage strategies in order to show your buyers that they can get more space without breaking the bank.

4. Upgrade the neighborhood - safety is a concern: We thought as Canadians we were immune to this. Start discussing crime rates, talk about insurance rates being 20% lower in certain areas, and make friends with your insurance broker who has this data for you to showcase and advertise with.

5. Wanting a vacation home: Vacation homes are still on peoples’ radar screens, especially for those who work from home. Prices are dropping on these, as the post pandemic cottage hangover is rearing its ugly head.

6. Those who have a net annual loss on their investment properties are potential sellers, but also buyers: This is a time to help investors hedge their higher priced investments with those which have better value (as investors offload some of their investments), and higher rental trajectory and growth.

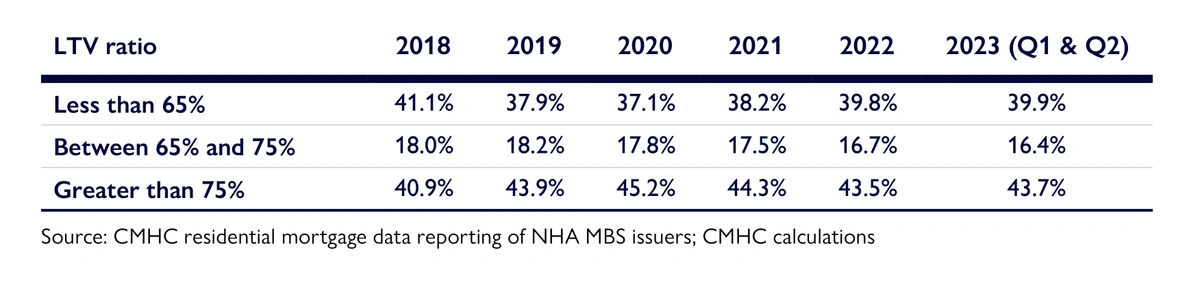

7. Lots of equity/lots of choice: 1/3 of purchases in 2024 will be cash. 29.65% have a mortgage in Canada, and approximately 33-35% rent, that leaves a third of Canadians without a mortgage. They have lives too, and they grow their households, they downsize, etc. When you look deeper into the loan-to-value ratios of Canadians, you will discover there is plenty of equity in them there hills.

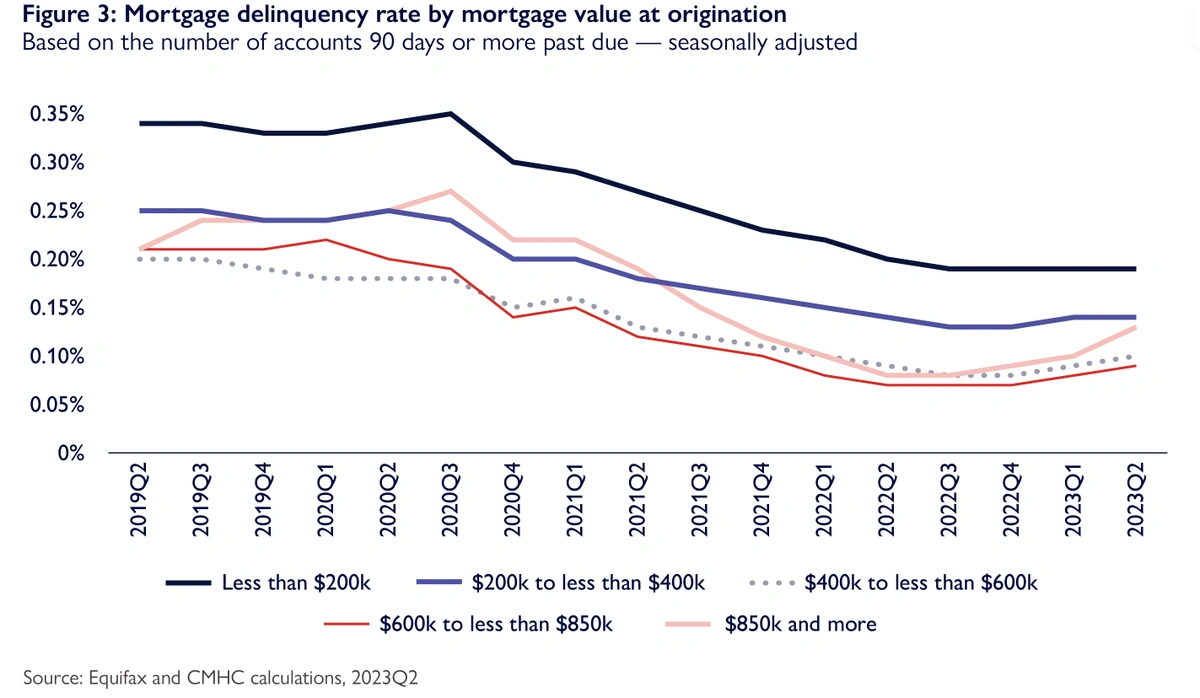

Also don’t expect defaults to bring about a colossal correction, however there is a trending upswing in the $850K and above mortgages. So tell your first timer buyers that homeowners are pretty strong at the entry level price points.

8. Legacy real estate and the transfer of wealth: Baby boomers want their kids and grandkids to have a house. Messaging those people about how to effectively do that is paramount. Have information ready for these folks such as tax implications, legal documents around co-ownership, asset protection, etc.. StatsCan just released a report about those born in the 90’s, between the ages of 24 and 33 (millennials), and had a home ownership rate of 8.1% in 2021. The rate increased to 14.7% if their parents owned a home, 22% if their parents owned 2 properties, and 27.8% if their parents owned 3 or more properties. In other words, their parent’s equity is flowing into real estate for their kids.

9. Time to downsize: This needs no explanation, however these buyers and sellers need a place to go, so it is incumbent upon us to create a curation of down-sizer inventory.

10. Out of area relocation: People are moving out of the province in search of an ideal place to retire or to find employment. Become an expert in relocation; get your ducks in a row to help them on the ground in their new location, and do what you can to get them the most when it comes to selling their property here.

11. Change of work, change of life, and change of home almost always follows: People are going back to their offices for part, or all of the week, but they love their suburban home. Maybe a pied- a-terre in that urban center is a great investment, a cool weekend getaway, and a commuter savior all at once.

12. Divorce and debt consolidation: These are frequent buzz words which are very searchable queries. Create valuable content around both topics and become that expert by collaborating with those who are a part of either of these ecosystems (family lawyers, bankruptcy trustees, etc.)

Thank Goodness the Bank of Canada’s Theory was Flawed

The BOC and the US Federal Reserve had a single mission. They wanted to reduce employment, which would in turn reduce inflation, because people would lose their jobs or fear they would lose their employment, and that would curb demand. Well, the inflation thing did drop because demand came down as the media kept telling us how expensive everything is, and that if we buy anything we do not need we are getting hosed. Employment remained strong, which is great, but what happened with their hypothesis of the unemployment rate as it correlates to higher borrowing costs?

The Bank of Canada and the Federal Reserve’s theory that higher interest rates would mean companies would not borrow to grow, and in turn lay off their employees is flawed. I ain’t no economist, but I did take a few courses in University, so I decided to compare interest rates and their effects on employment. In 2005, the Bank of Canada set rates at 2.5%, and unemployment was 6.76%. In July of 2010, the BOC rate was .75% and unemployment was a whopping 8.6%. In 2015 it was .75%, and unemployment was 6.9%. And today, the BOC Policy Interest Rate is at 5%, and unemployment is 5.7%.

What Does a Win Look Like in 2024?

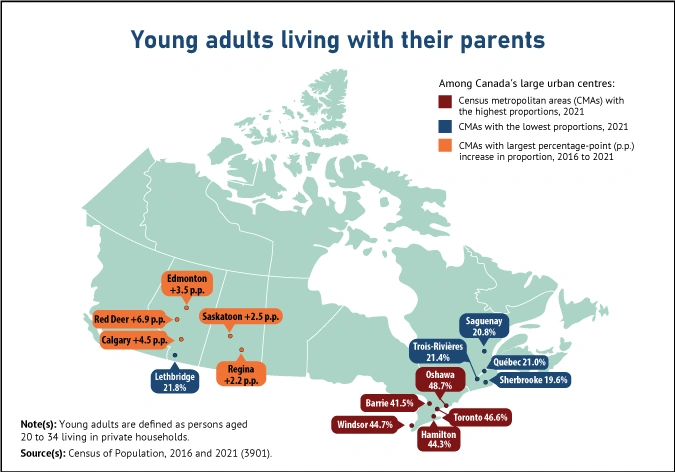

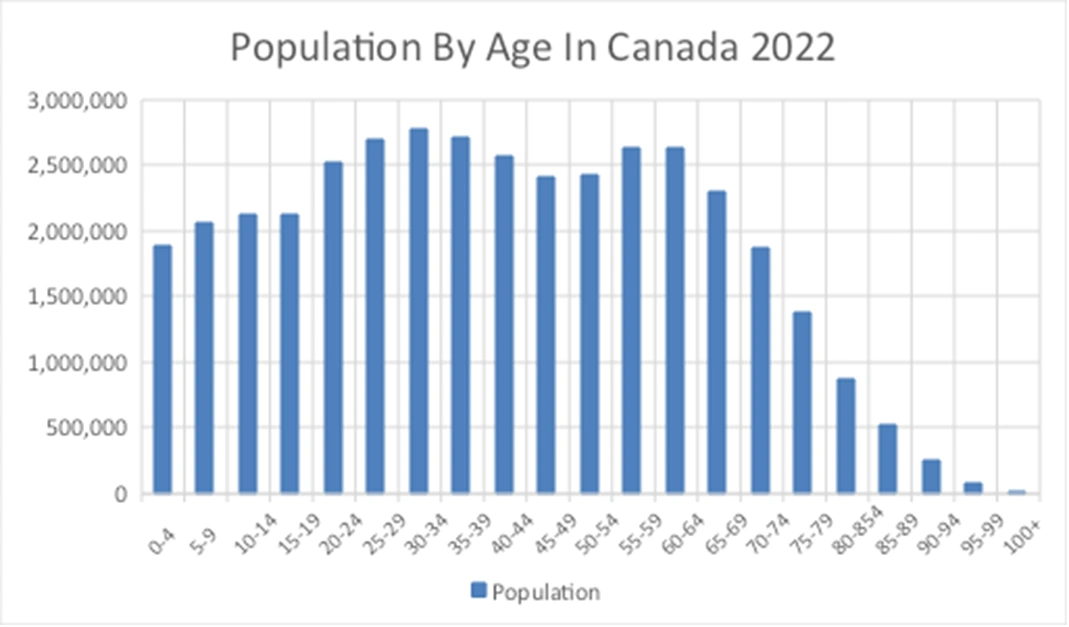

My bet is going to be on the Millennials in Canada in 2024. They number 10,778,118 which is slightly more than a 1/4 of our population. They can’t live in their parents’ basements forever. The average household in Canada forms at age 26. If these newly created households are paying rent, its high. This is the largest home buying demographic in history, and they have jobs and equity from their parents and grandparents. The rest of this decade is going to be shaped by this large buying group. They will move the market like the baby boomers before them, when they were in their household creation years of the mid 80’s.